Background

Australia’s formal name is the Commonwealth of Australia. The form of government used in Australia is a constitutional monarchy – ‘constitutional’ because the powers and procedures of the Australian Government are defined by a written constitution, and ‘monarchy’ because Australia’s head of state is King Charles III.

The Commonwealth of Australia was formed in 1901 when six independent British colonies agreed to join together and become states of a new nation. The rules of government for this new nation were enshrined in the Australian Constitution, which defined how the Australian Government was to operate and what issues it could pass laws on. The Constitution created a ‘federal’ system of government. Under a federal system, powers are divided between a central government and individual states. In Australia, power was divided between the Australian Government and the six state governments.

The Australian Commonwealth and the States

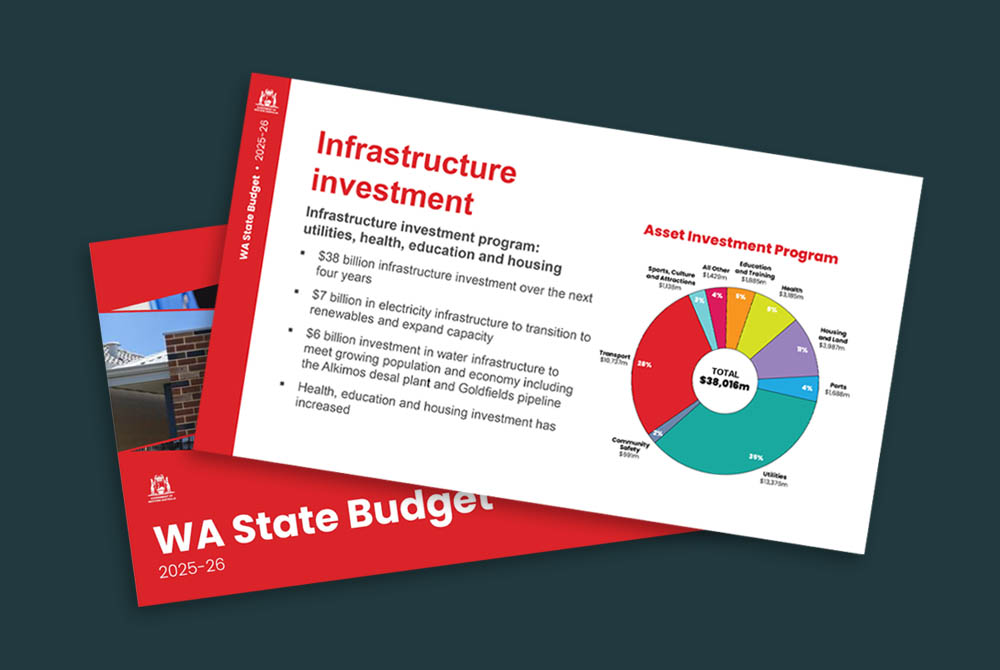

Allocated powers under the Australian constitution over matters of national interest including defence, external affairs, international trade and commerce, currency and banking.

State governments retain power and responsibility over all matters not delegated to the Commonwealth under the constitution. These include education, public health, police and justice system, roads, railways, ports, electricity and water supply etc.

Taxes levied under national legislation include personal income tax, corporate tax, excise and customs duties, royalties on offshore natural resources and the Goods and Services Tax (GST). All revenue (net of administration costs) from the GST is allocated to the states.

The states impose and have full constitutional control over payroll taxes, stamp duties, land taxes, gambling taxes and royalties on onshore natural resources.

Vertical and Horizontal Imbalances and Equalisation Methods – A Tightly Linked Fiscal Relationship

The Australian Commonwealth, State and Territory Governments have a tight fiscal relationship, with the goal to provide all Australians with comparable levels of health, education, justice, welfare, public housing, and other services regardless of the state in which they live.

The Commonwealth and the States and Territories have a tight fiscal relationship – however, there is an imbalance between revenues and spending requirements:

- The Commonwealth Government collects the majority of total government revenue, and the States and Territories oversee approximately half of total government spending.

- The Commonwealth therefore provides the State and Territory Governments with a large portion of their revenues via grants, which come in three forms – GST, specific purpose and general revenue assistance grants.

The Commonwealth also works to smooth revenue imbalances between the States and Territories through the Horizontal Fiscal Equalisation (HFE) framework which:

- Endeavours to equalise the fiscal capacity of each State and Territory to provide a consistent level of services to residents of each through the relative distribution of GST.

- Is set out in the Intergovernmental Agreement on Federal Financial Relations. GST revenue sharing relativities are updated annually while the methods used for calculating the relativities are reviewed every five years.

Western Australia is a Strong Net Contributor to the Commonwealth

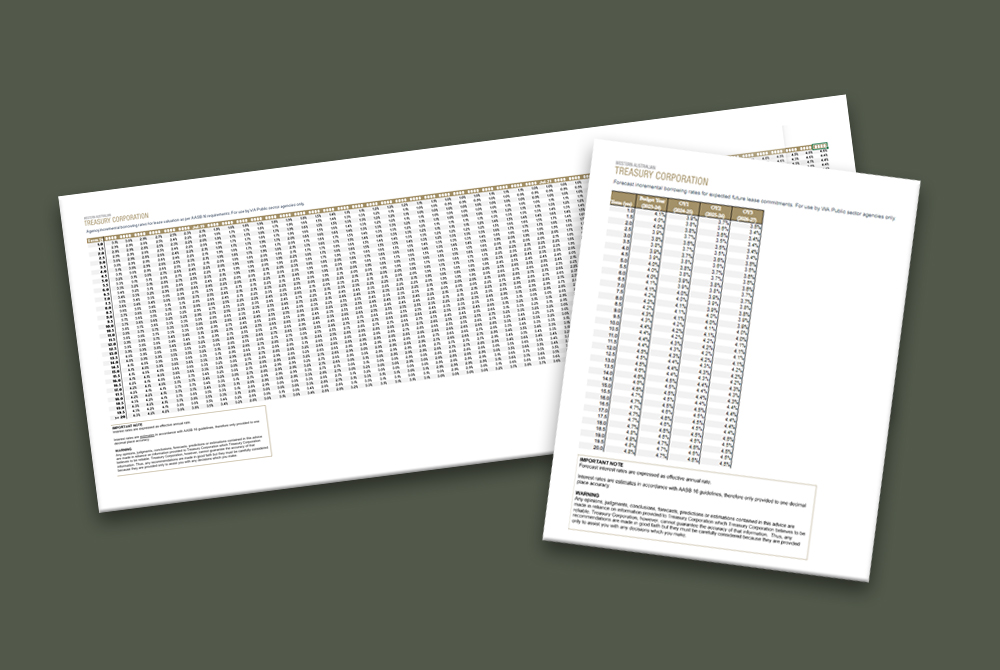

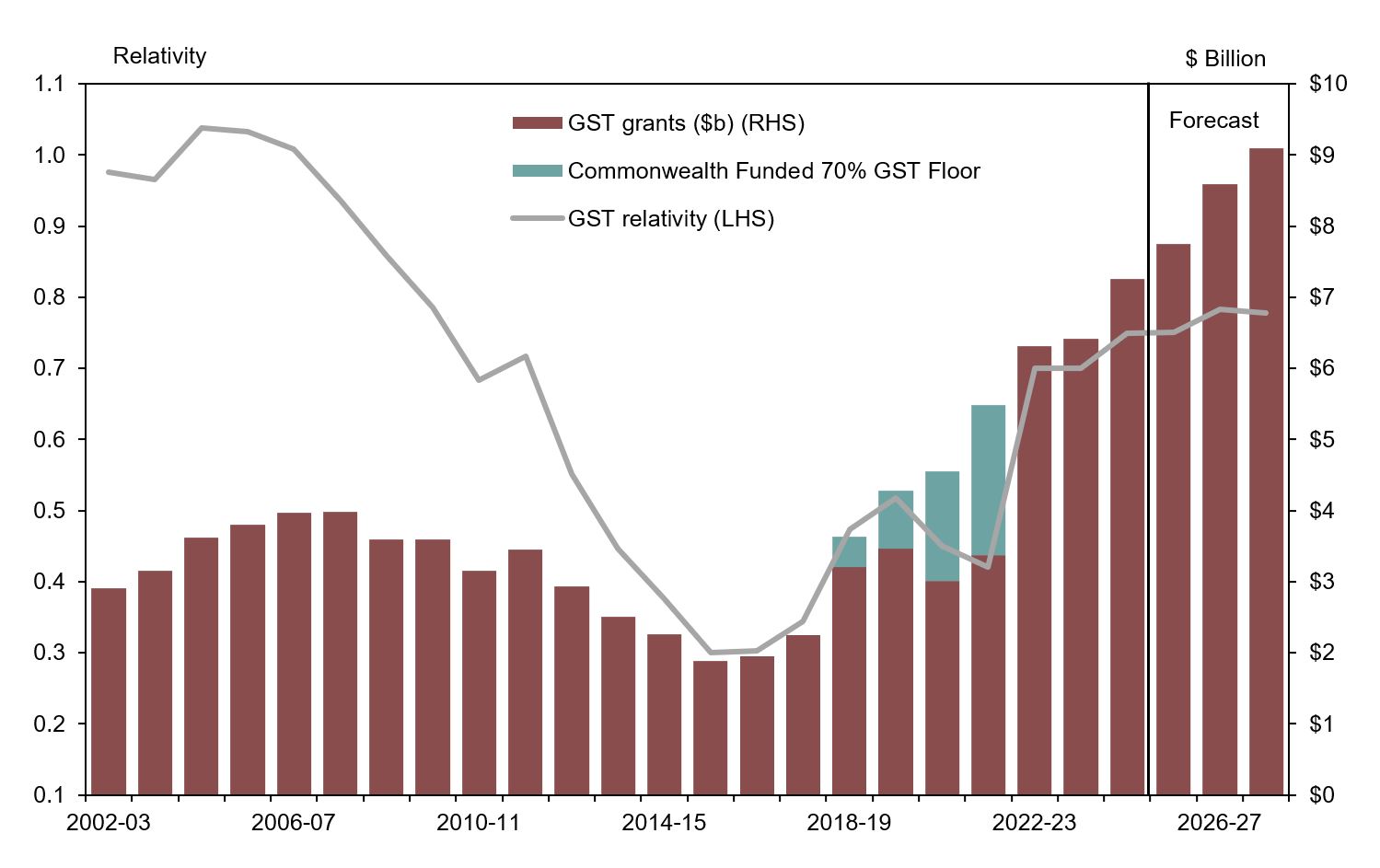

The Commonwealth Government assesses the fiscal capacity of each Australian state to determine a re-distribution of GST revenue to strengthen the capacity of those states with weaker fiscal capacity. The graph below represents Western Australia’s share of GST revenue, including Commonwealth top-ups to bring the GST relativity to 70%, and the percentage of GST returned to Western Australia. The GST relativity floor rises to 75% from 2024–25.

Western Australia's GST Revenue

Source – Western Australian Department of Treasury

Investor Enquiries

To contact our Financial Markets team and discuss institutional investment please email financialmarkets@watc.wa.gov.au.