Debt Portfolio Manager Service

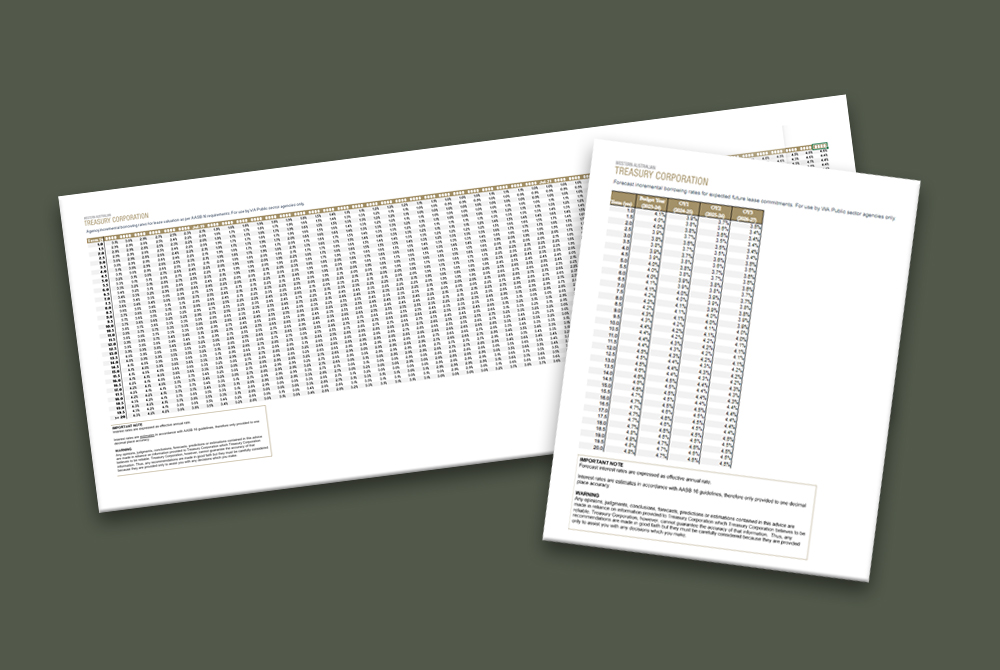

The Debt Portfolio Manager (DPM) is a passive debt management service designed to effectively manage interest rate risk in a way that meets our clients’ individual business requirements. The DPM service is administratively efficient as it automatically allocates new debt and refinances maturing debt, within separate portfolios of term fixed rate and/or term floating rate loans that comply with the interest rate risk management settings established by the client.

Our team can assist clients in determining the interest rate risk management settings most appropriate for their business.

- Debt Portfolio Manager – Information Sheet

Find out more about this service.

Interest Cost Projection Service

The Interest Cost Projection (ICP) service supports the improvement of project costing estimations and budgeting accuracy by providing robust forecasts of future interest costs. This service helps clients to manage and report on their future expected debt levels and the associated interest costs, and supports informed decision making when considering debt finance options.

Utilising sophisticated financial modelling and incorporating our financial markets expertise, the ICP system models debt portfolio and future borrowing requirements to determine future expected interest costs.

- Interest Rate Cost Projection Service – Information Sheet

Find out more about this service.

Debt Structure Analysis and Advice

Effective debt management requires selecting the most appropriate debt structure to meet the specific requirements of each client. This involves assessing and analysing alternate debt portfolios, evaluating the cost and risk characteristics of alternate debt structures and effectively communicating the risk/cost trade-off, to ensure a debt portfolio is selected that meets an acceptable risk tolerance and the client's requirements.

Our service offering includes:

- Developing stochastic interest rate models

- Developing appropriate risk and return metrics

- Applying specialist knowledge of interest rate risk management techniques

- Analysing all forms of financial risk and modelling results

- Evaluating client business requirements

- Assisting clients in understanding, quantifying and articulating their risk appetite

- Developing equilibrium (rather than arbitrage pricing) risk models

- Developing appropriate risk metrics for long-run analysis of debt portfolio structures

- Interest cost modelling and providing clients with estimates of projected interest costs and potential variation in estimates for budgetary planning

- Evaluating alternate active debt management strategies.

Banner images:

Top - A ferry in Elizabeth Quay, Perth. Image courtesy of Tourism Australia.

Below - The Swan Bell Tower in Elizabeth Quay, Perth. Image courtesy of Tourism Australia.

Loan Products

We offer a comprehensive range of loan products including short and long term and fixed and floating options.