Western Australian economy remains resilient

The Western Australian economy continues to withstand a range of global and domestic challenges. Strong economic fundamentals mean that the State is well positioned to withstand the current and potential challenges.

The Western Australian economy continues to withstand a range of global and domestic challenges, including the elevated geopolitical tensions in Europe, significant tightening of global and Australian monetary policies, slower growth in China as well as persisting supply-side constraints and ongoing cost-of-living pressures. Strong economic fundamentals mean that the State is well positioned to withstand the current and potential challenges.

In the final quarter of 2022-23, Western Australian state final demand rose by 0.4%, to be 3.7% up through the year, the most of all States. This solid performance was supported by a rise in private investment and consumer spending, despite the tightening of monetary policy and higher costs of living.

While Australia’s economic growth overall is forecast to slow further, the slowdown is expected to be less pronounced in Western Australia. Treasury WA forecasts that gross state product will increase by a solid 2.25% in 2023-24, supported by an acceleration in investment growth, both private and public, and ongoing demand for commodities exported by the State.

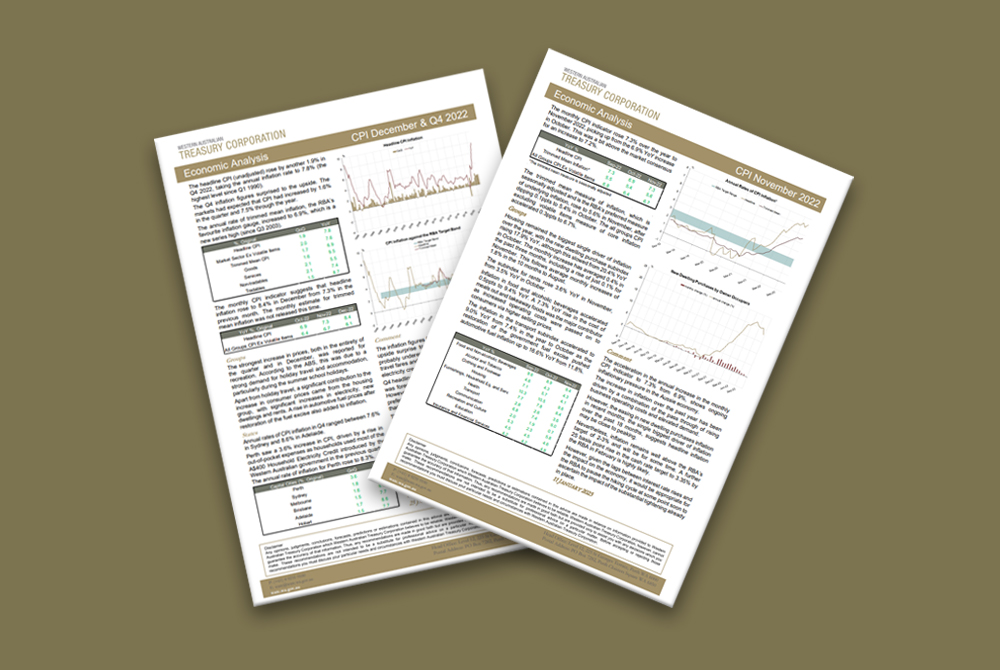

While still acute, cost of living pressures also appear to have eased in Western Australia towards the end of 2022-23. In the final quarter of 2022-23, the annual rate of Perth CPI inflation declined to 4.9%, which is the lowest level of all states.

Western Australian employment continues to rise robustly, having outpaced the nationwide gains since the start of the pandemic (10.7% against an 8.3% increase since February 2020). At 3.7%, the Western Australian unemployment rate is close to its historical lows. It is expected to remain very low in the coming years, with Treasury WA forecasting a rise to a still relatively low level of only 4.5% in 2025-26. The participation rate in Western Australia, at 69.3%, is by far the highest of all states.

The growth in Western Australian wages in the final quarter of 2022-23 of 4.2% YoY, was also the fastest of all states. This was despite the wages being already relatively high, with average weekly earnings at A$2,039.30 compared to A$1,838.10 nationwide towards the end of 2022-23.

Relatively high wages, coupled with lower house prices compared to some other states, translate into housing remaining affordable for Western Australian families. According to CoreLogic data, the median house price in Perth is around 25% lower than for all capital cities. The lower house prices translate into a 20% lower size of an average housing loan in Western Australia compared to the entire nation. The relative stability and affordability of Western Australian housing, as well as the relatively small sizes of housing loans, should be factors cushioning the adverse impacts of higher mortgage rates or an unexpected pick-up in unemployment.

These factors supporting stability of the household sector are coupled with stability of the public finances. Thanks to sustained economic growth, balance sheet repairs and strong revenues, the State Government delivered its sixth consecutive budget surplus, with further surpluses forecast for the coming years. Net debt is forecast to remain below 10% of gross state product over the coming years, which is a flatter debt profile than other jurisdictions.

Taking into account the above, in early July 2023 Moody’s Investors Service upgraded Western Australia’s and WATC’s credit rating to the top ‘Aaa’ with ‘stable’ outlook. This followed a similar upgrade by S&P Global Ratings a year before. Western Australia is the only State or Territory with the top rating from both major international agencies and one of a very small number of jurisdictions boasting such a rating.

Image below - Pilbara Port. Image courtesy of Pilbara Ports Authority.