View the most significant economic and financial market events from around the world and in Australia over the last week, including movements in interest rates, equities, currencies and commodities, as well as snapshots of global and domestic economies.

- 27 Jun 2025 Market WATCh Weekly 27 June 2025

In Australia, the monthly CPI indicator suggested that headline and trimmed mean inflation declined further in May and remained within the 2-3% target range. The S&P Global flash PMIs pointed to faster, albeit still quite moderate expansion of the Australian private sector in June. Abroad, S&P Global flash PMIs also pointed to ongoing expansion in the major advanced economies in June.

- 20 Jun 2025 Market WATCh Weekly 20 June 2025

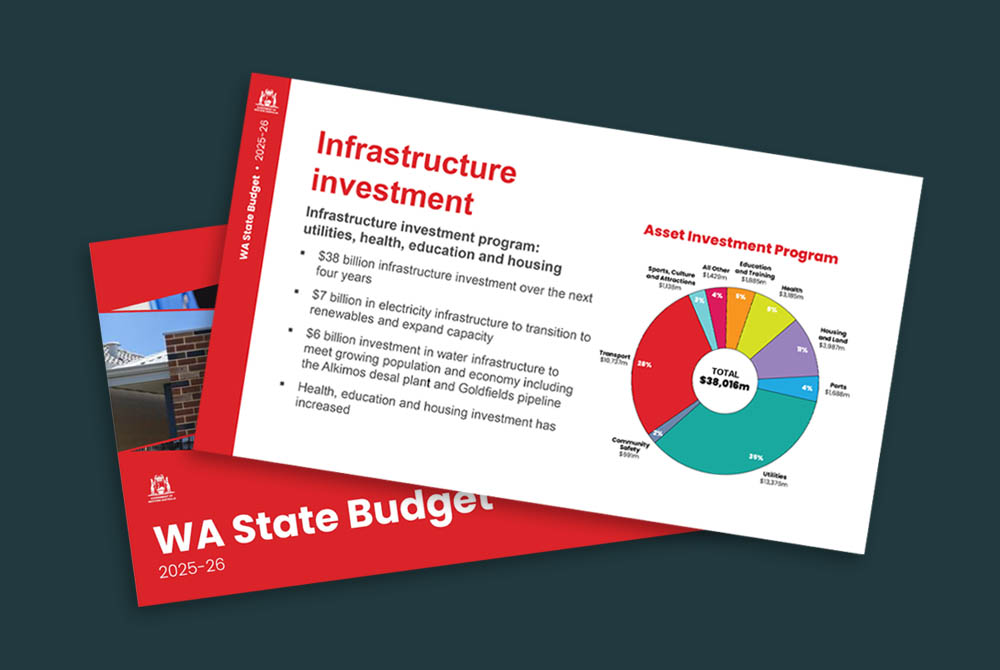

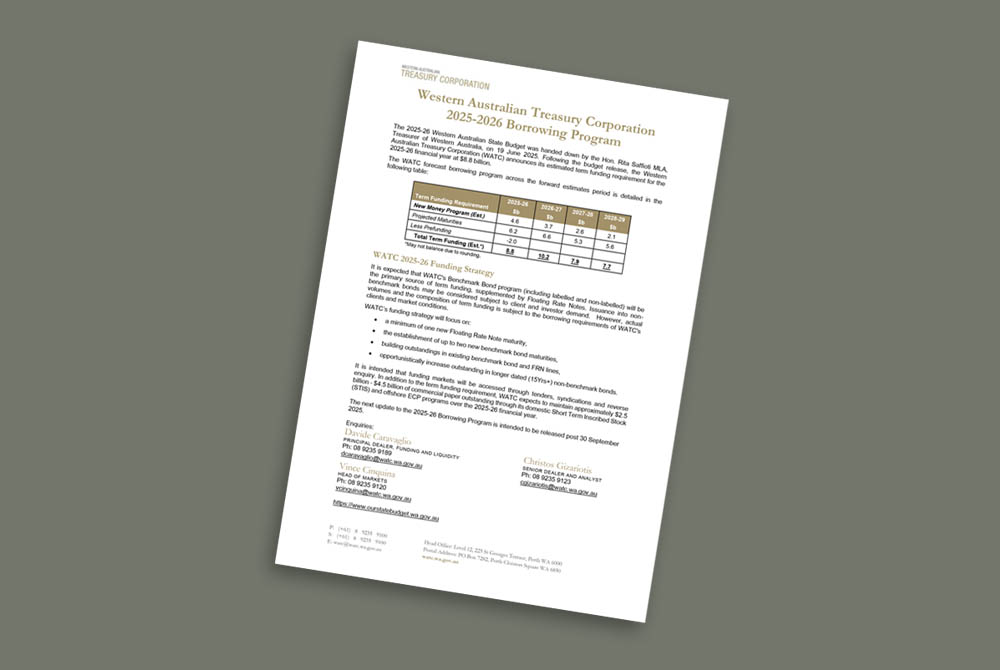

The Western Australian 2025-26 State Budget again confirmed the solid fiscal position of the State, with ongoing surpluses and debt kept in check. Nationwide, Australian seasonally adjusted employment unexpectedly ebbed in May, but the unemployment rate remained steady at 4.1%.

- 13 Jun 2025 Market WATCh Weekly 13 June 2025

In Australia, NAB business conditions weakened in May, while business confidence picked up but remained subdued. Westpac consumer sentiment rose a little further in June but is still depressed. Abroad, US inflation figures generally surprised to the downside in May. The Chinese trade figures remained resilient to trade tensions in May, with iron ore imports still high by historical standards.

- 06 Jun 2025 Market WATCh Weekly 6 June 2025

In Australia, real GDP growth disappointed in Q1, while the current account deficit narrowed amid a decline in the primary income deficit. This was followed by soft household spending growth and a fall in goods trade surplus in April. Home price growth accelerated in May, while the Melbourne Institute inflation gauge pointed to a decline in consumer price inflation in May.

- 30 May 2025 Market WATCh Weekly 30 May 2025

In Australia, the monthly CPI indicator suggested that both headline and trimmed mean inflation remained in the RBA target range in April. Abroad, some of US tariffs were blocked by a US trade court, before being temporarily reinstated by an appeals court.

- 23 May 2025 Market WATCh Weekly 23 May 2025

In Australia, the RBA cut the cash rate by 25bps to 3.85% as expected, and turned more dovish. The S&P Global PMIs suggested a slower pace of expansion in the private sector in May.

Quick Links

Banner image top - Matagarup Bridge, Perth. Image courtesy of Tourism Western Australia.