The Consumer Price Index (CPI) measures inflation through the change in prices that households pay for goods and services. The Reserve Bank of Australia targets a CPI inflation rate of 2-3 per cent. This note presents an overview and commentary on the most recent CPI data.

- 28 Jan 2026 CPI December & Q4 2025

The headline CPI rose by 0.6% in Q4 2025, in line with market expectations, taking the annual rate of headline inflation to 3.6%.

- 07 Jan 2026 CPI November 2025

The all-groups unadjusted CPI was unchanged for the second month in a row in November, with the annual rate easing 0.4ppts to 3.4%. The seasonally adjusted CPI rose by 0.2% in the month following a 0.4% increase in October, to be up by 3.5% YoY.

- 26 Nov 2025 CPI October 2025

The inaugural monthly CPI report showed that the unadjusted headline CPI was unchanged in October, but the annual rate of consumer price inflation increased by 0.2ppts to 3.8%, against market expectations of no change.

- 29 Oct 2025 CPI September 2025

The headline CPI rose by 1.3% in Q3 2025, taking the annual rate of inflation 1.1ppts higher to 3.2%. This was an upside surprise to market participants who expected a rise of 1.1% QoQ and 3.0% YoY. The trimmed mean CPI, which is the RBA’s preferred underlying price gauge, rose by 1.0% QoQ and 3.0% YoY (mkt exp.: 0.8% QoQ and 2.7% YoY).

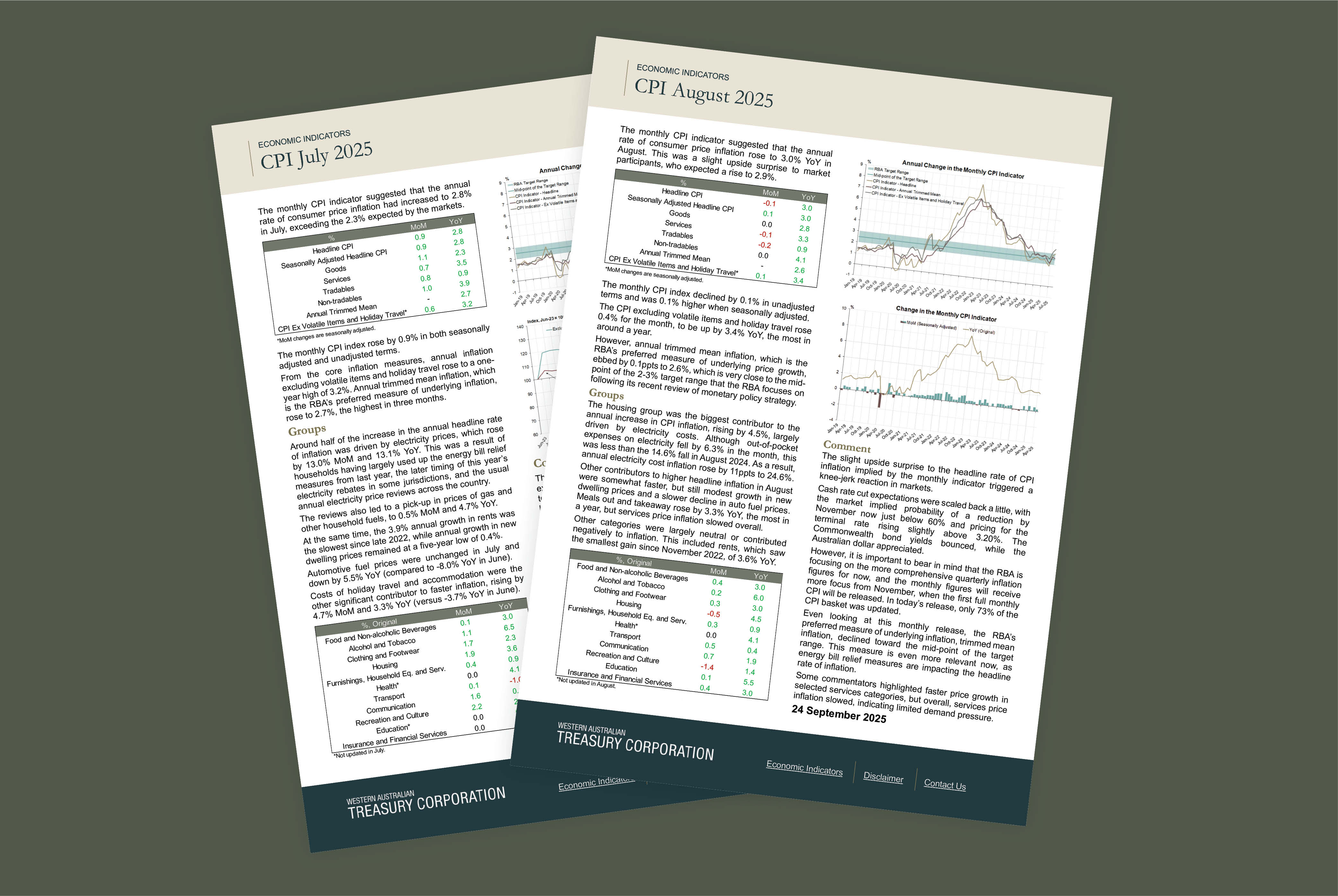

- 24 Sep 2025 CPI August 2025

The monthly CPI indicator suggested that the annual rate of consumer price inflation rose to 3.0% YoY in August. This was a slight upside surprise to market participants, who expected a rise to 2.9%. Annual trimmed mean inflation, which is the RBA’s preferred measure of underlying price growth, ebbed by 0.1ppts to 2.6%, which is very close to the mid-point of the 2-3% target range.

- 27 Aug 2025 CPI July 2025

The monthly CPI indicator suggested that the annual rate of consumer price inflation had increased to 2.8% in July, exceeding the 2.3% expected by the markets. The stronger-than-expected rise in inflation implied from the CPI indicator came from the rise in out-of-pocket expenses for electricity and the solid rise in costs of holiday travel and accommodation.